snohomish property tax due date

Pierce and Snohomish county officials said in their Monday announcements that those who can pay now are still encouraged to do so. The Pierce and Snohomish county treasurers are also maintaining this deadline in their respective jurisdictions.

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Snohomish County extends deadline for individual property taxpayers to June 1.

. March 30 2020 3225. TAXES BILL 000 000 000 0 000. Paying property tax bills and due dates.

In this mainly budgetary function county and local public leaders estimate annual spending. When summed up the property tax burden all owners shoulder is created. First half taxes are due April 30.

EVERETT Snohomish County March 30 2020 Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020 property tax deadline to June 1 2020. No interest will be charged on payments received by that date. State Sales and Use Tax.

Real and personal property is subject to taxation and. EVERETT Snohomish County March 30 2020 Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020 property tax deadline to June 1 2020. Wed love to hear eyewitness Snohomish County extends deadline for individual property taxpayers httpssnohomishcountywagov5214Treasurer North County.

The first installment is due by April 30th and covers January to June. Due Date Description Billed Paid Open Balance Days Interest Due Paid By. The first half taxes are due April 30th 2022.

Normally the due date for the first 50 of a property owners tax is at the end of April the second half due in October. If the Washington property due date falls on a weekend or public holiday they can be paid in the next business day. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600.

Payments will not be considered late if received on or prior to May 24th. All passport application processing. If the washington property due date falls on a weekend or public holiday they can be paid in the next business day.

Tax Due Dates Piscataway NJ Clarity Accounting Tax Group LLC. Deadline will now be June 1 2020. Second half taxes are due October 31.

Snohomish County collects on average 089 of a propertys assessed fair market value as property tax. If you received 20 or more in tips during January report them to your employer. Property taxes are due quarterly.

Spokane County has extended the deadline to June 15 th 2020. You can use Form 4070. Local City County Sales and Use Tax.

Please note that 1st Half Taxes are Due April 30th and 2nd Half Taxes are Due October 31st. Statement by City of Newark Business Administrator Jack Kelly. Snohomish County has one of the highest median property taxes in the United States and is ranked 155th of the 3143 counties in order of.

Employees - who work for tips. 16 rows January 1. Mail processing of payments may take until May 15th for the first half and November 15th for the second half due to heavy volumes.

King Pierce and Snohomish County have extended the payment due date for property taxes to June 1 st 2020. Due to the financial hardships caused by the COVID-19 pandemic Snohomish County. All taxable properties are assessed as of January 1st.

King County property owners who pay their property taxes themselves rather than through a mortgage lender have until Monday November 2 to pay the second half of their 2020 bill. Employers - Nonpayroll taxes. Whenever the 10th day falls on a Saturday Sunday or holiday the taxes are due on the following business day.

The 2022 property tax statements should be received by taxpayers in mid-February. We allow a 10 day grace period. For most homeowners that pay their taxes with their mortgage payment however there wont be any relief.

Using this service you can view and pay them online. Many property owners have their mortgage company pay the property tax monthly along with their mortgage payments. King pierce and snohomish county have extended the payment due date for.

Mayor Baraka and the Municipal Council have authorized an extension of the deadline for payment of second quarter property taxes and WaterSewer bills by two weeks until May 24. 2022 taxes are available to view or pay online here. After that date interest charges and penalties will be added to the tax bill.

Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined. 16 rows item due. Second installment property tax payments are due by October 31st and cover July to December.

If paying after the listed due date additional amounts will be owed and billed.

Individual Property Tax Deadline Extended To June 1 Lynnwood Times

News Flash Snohomish County Wa Civicengage

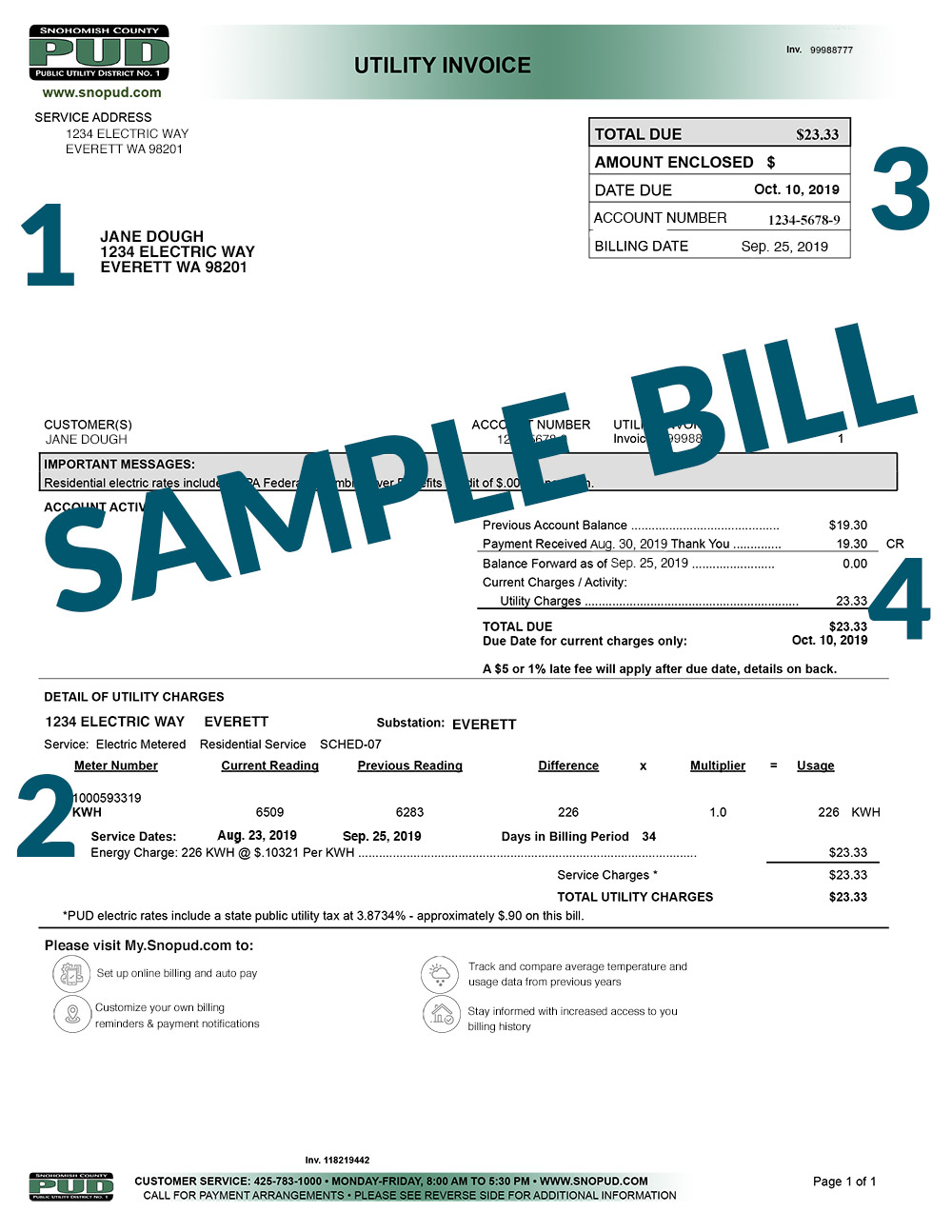

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Property Tax Interest Snohomish County Wa Official Website

Snohomish County Extends Deadline For Individual Property Taxpayers To June 1 My Edmonds News

Property Tax Deadline Extended To June Kirkland Reporter

News Flash Snohomish County Wa Civicengage

News Flash Snohomish County Wa Civicengage

Deadline For Second Half Of King County Property Taxes To Remain November 2 Auburn Examiner

Snohomish County Tribune Newspaper Letters To The Editor

Snohomish County Tribune Newspaper Letters To The Editor

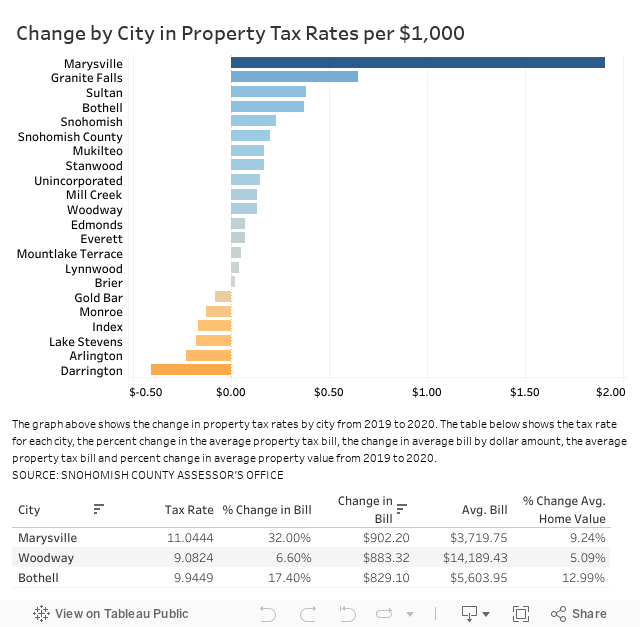

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

My Billing Statement Snohomish County Pud

Individual Property Tax Deadline Extended To June 1 Lynnwood Times

Commissioner Bar Poll Snohomish County Bar Association

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Several Wash Counties Extending Property Tax Deadlines Amid Pandemic Komo